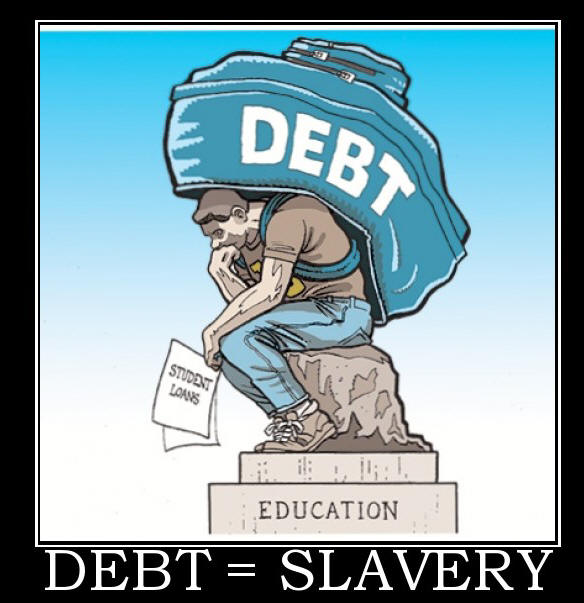

TIME TO BREAK THE CHAINS!

ALL STUDENT DEBTORS MUST GET

THE RIGHT TO BANKRUPTCY PROTECTION!

Student debt is a major financial crisis in America.

Consumers owe more on their student loans than their credit cards.

Student loans outstanding today — both federal and private — total some

$1.7 trillion

Unfortunately, student debt is the only form of US debt that cannot be

relieved by bankruptcy

While student loan debt was dischargeable in bankruptcy prior to 1978, the US Bankruptcy Code of 1978 made an exception for bankruptcy discharge of education loans This law was strengthened as recently as 2005 with the Bankruptcy Abuse Protection Act. (Finaid) The fact that these loans are not dischargeable through bankruptcy is a uniquely harsh measure that even gambling and credit card debt is not subject to.

It is time to change the law so that students can declare bankruptcy on their debt.

Want to Help Struggling Student Loan Borrowers? Start with Bankruptcy Reform (Demos, 5-31-17)

Bankruptcy Bills

Steve Cohen's Bill

H.R.138 - Private Student Loan Bankruptcy Fairness Act of 2023

This bill modifies the treatment of certain student loans in bankruptcy.

Specifically, it allows private student loans to be discharged in bankruptcy regardless of whether a debtor demonstrates undue hardship. Under current law, student loans may be discharged in bankruptcy only if the loans impose an undue hardship on the debtor.

Below are older bills. But they are still relevant.

Richard Durbin's Bills

2598 - FRESH START Through Bankruptcy Act (2021-2022)

S.1414 - A Bill to Provide Bankruptcy Relief for Student Borrowers (2019-2020)

Press Release (Dick Durbin Official Website, 5-9-19)

On May 9th, 2019, U.S. Senators Dick Durbin (D-IL) and Elizabeth Warren (D-MA), along with U.S. Representatives Jerrold Nadler (D-NY-01) and John Katko (R-NY-24), introduced a bicameral bill that would give Americans overwhelmed by student loan debt the option of obtaining meaningful bankruptcy relief. The "Student Borrower Bankruptcy Relief Act of 2019" would eliminate the section of the bankruptcy code that makes private and federal student loans nondischargeable, allowing these loans to be treated like nearly all other forms of consumer debt.

Dick Durbin said the following about the bill: “Filing for bankruptcy should be a last resort, but for those student borrowers who have no realistic path to pay back their crushing student loan debt, it should be available as an option to help them get back on their feet. Our nation faces a student debt crisis, and it’s time to restore the meaningful availability of bankruptcy relief to student loan borrowers.” (Dick Durbin)

Elizabeth Warren said the following about the bill: “Long before I came to the Senate, I fought my heart out to keep student loans dischargeable in bankruptcy. But over and over again, Congress chipped away at this critical protection for student loan borrowers. The Student Borrower Bankruptcy Relief Act fully restores this protection, and I’m thrilled to work with Senator Durbin to fight for this legislation.” (Dick Durbin)

John Katko's Bill

H.R. 770 Discharge Student Loans in Bankruptcy Act of 2019

Questions about potential illegality by Navient, one of the main servicers of student loans. See the CNBC article here.

Navient ended its federal student loan servicing contract after December 2021 and its portfolio was then transferred to Aidvantage.

SEE OUR MAIN PAGE ON STUDENT LOANS

The Human Side of the Crisis

Default: the Student Loan Documentary (Broadcast Version)

Bankruptcy Questions:

FinAid.org - Bankruptcy Questions

Student Loan Finance Reform:

S.1162 - Bank on Students Emergency Loan Refinancing Act Sponsor: Elizabeth Warren (D) Cosponsor: Richard Durbin (D) and 36 others

This legislation would allow those with outstanding student loan debt to refinance at the interest rates offered to new federal borrowers in the 2016-2017 school year.

How to Receive Help on Student Loans?

For more information on your personal student loan forgiveness status, make an account with the website above and log in.

Then if you want to learn more about the SAVE loan repayment plan, you can go here. There are also details about this new plan on the White House's website.

What is the SAVE Plan? Those who struggle to pay their student loan payments can look into the new income-driven repayment plan called the SAVE Plan. The SAVE plan is supposed to reduce monthly payments by increasing the income exemption from 150% to 225% of the poverty line. This means a single person earning less than $32,805 a year will potentially have monthly payments of $0. The same would happen to families of four that make less than $67,500.

Related World Future Fund Reports:

Education Spending: An Area Where America Spends More and Gets Less

Broadband for All (How the internet can help replace some of the need for college education.)

More Resources for Student Loan Borrowers

You are not alone. The following links can help you better understand your rights, find peers in the same situation as yourself, and help make your voice heard.

Related Articles

Student Loan Debt vs Other Debts (Education Data Initiative, 8-9-23)

Student loans: What to know before payments resume in October (CNN, 8-31-23)

Why Biden’s new SAVE student loan income driven plan is a game changer (Washington Post, 8-30-23)

Government Regulators and Law

Concerning Student Loans

Consumer

Financial Protection Bureau

Federal

Deposit Insurance Corporation

Federal Trade Commission

Dodd-Frank Wall Street Reform and Consumer Protection Act

Consumer Action - Financial Reform Quick Fact Sheet (pdf file)

Advocacy Groups

Student Loan

Borrower Assistance

Student Loan

Justice Facebook Alan

Collinge Facebook

Consumer Affairs - Student Loan Section

Legal Assistance

Find Law