GLOBAL DEBT CRISIS 2018

DEBT HAS TO CONTINUED TO GROW

AS WESTERN GOVERNMENTS PAPER OVER PROBLEMS

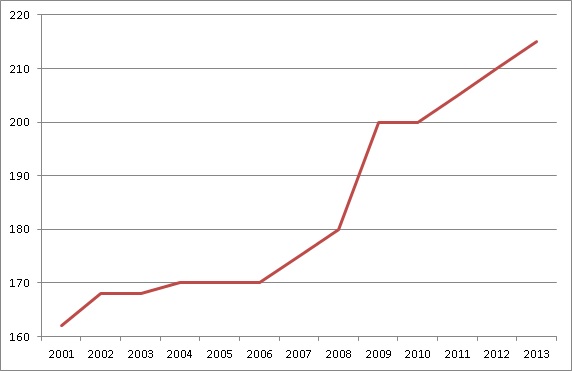

WORLD TOTAL DEBT AS A PERCENT OF GDP

(EXCLUDING THE FINANCIAL SECTOR)

(Source For Chart's Data: Geneva Report on the World Economy) Numbers above are estimates based on original chart figures.

AFTER 2008 FINANCIAL CRASH, GLOBAL DEBT GROWS TO A RECORD $158.8 TRILLION

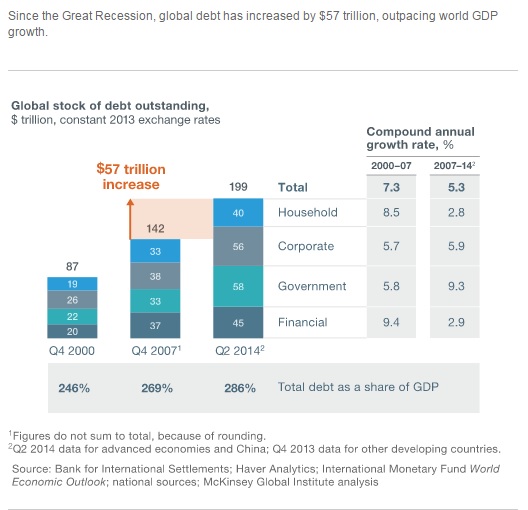

Seven years after the global economic bubble burst, levels of global debt have skyrocketed, and only continue to grow larger with each passing year. In fact, rather than reducing indebtedness, or deleveraging, all major economies today have higher levels of borrowing relative to GDP than they did in 2007 when the crisis began. Global debt in these years has grown by $57 trillion, raising the ratio of debt to GDP by 17 percentage points. This unsustainable level of debt poses new risks to financial stability and may undermine global economic growth (McKinsey Report).

According to the Geneva Report released in 2014 about the World Economy, the global debt has reached a record level of $158.8 trillion. This record level of global debt coupled with low economic growth is creating a serious threat of a new financial crisis in the horizon, states the sixteenth annual Geneva Report (Geneva Report).

MASSIVE AMOUNTS OF DEBT HAVE BEEN RUN UP TO PAY THE RICH

However, what isn't being widely discussed is how much of this debt has been run up to pay for massive bail outs for the rich. After all, the debt didn't come out of nowhere. The financial crisis of 2008 was followed by a liquidity crunch, decreased tax revenues, huge economic stimulus programs and recapitalizations of banks. This all led to a dramatic increase in the public debt for most advanced economies.

In America alone, there was a $12 trillion dollar bailout, where money from the national government (money from tax payers) went towards banks, companies, mortgage backed securities, currency swaps and private investments. The money spent so far is higher than the cost of World War II in constant dollars. (Bail Out Cost, World Future Fund Report). However, while the rich were bailed out with tax payers' money, the rest of America was not. Even after the bailout there were still massive foreclosures on homes, evictions and a prolonged period of unemployment that continues into today. The "official" unemployment numbers do not reflect the real situation in America. The reality is that there are less jobs now for Americans than when this century first began. In fact, if we measured unemployment today in the same way that we did during the Great Depression of the 1930's, today's unemployment would be worse than any single year of the Great Depression. Even with the Fed saying that unemployment rates are at "6.5%," much of the numbers are very doctored. The official numbers do not take into account the people who have dropped out of the job market completely and given up looking for work. (Against Crony Capitalism, 3-24-14).

There is also an argument that America's largest banking institutions and corporations have not only become too big to fail, but also too big to go to trial and too big to jail. Are regulators watching out for the American public or the banks? When Elizabeth Warren asks regulators why they won't turn over the case records to the victims of illegal home foreclosures she gets no answer. The regulators admit to having evidence of illegal bank activity, but they will not turn over this evidence to the public.Senator Elizabeth Warren asks Federal Bank Regulators when was the last time they took one of the biggest financial institutions on Wall Street all the way to a trial.After much fumbling and bureaucratic fluff, the answer was never. (Has too big to fail become too big to jail? World Future Fund Report)

So while much of the money of tax payers has been used to prop up institutions "too big to fail," very little has actually been done to build up the infrastructure of the American economy.

HOW TO REDUCE THE DEBT?

For six of the most highly indebted countries, starting the process of deleveraging would require implausibly large increases in real-GDP growth or extremely deep fiscal adjustments. To reduce government debt, countries may need to consider new approaches, such as more extensive asset sales, one-time taxes on wealth, and more efficient debt-restructuring programs.

We have included a picture below of the rising levels of global debt from 2000-2014.

THE INCREASE IN GLOBAL DEBT

(Original Source of Chart Image: McKinsey Report)

THE ARGENTINA DEBT CRISIS THROWS THE POSSIBILITY OF RENEGOTIATING PUBLIC DEBT INTO DOUBT

As mentioned above, debt restructuring programs would be helpful in managing today's global debt crisis. However, the 2014 U.S. court ruling that pushed Argentina into default may jeopardize the ability of other nation's to restructure debt in the future.

Argentina's economy crashed in 2001. The various creditors that owned 93% of Argentina's debt agreed to accept a payment of $0.30 on the dollar to forgive the loans. Most of the bondholders agreed to take a haircut in order to get something back. However, the creditors that owned 7% of this debt demanded full repayment. These hold-outs bought the bonds cheap in the hopes of making Argentina repay the full amount. A condition of the bond is that all bondholders must be treated the same; meaning, if Argentina pays the hold-outs the full amount, they have to pay everyone the full amount. Obviously Argentina didn't have the money to do this, so they instead decided to pay the bondholders who agreed to take a haircut. Argentina deposited $539 million to the Bank of New York Mellon that was supposed to be distributed in time to meet the July 30th 2014 deadline. However, this is where matters get somewhat hairy.

The hold-outs succeeded in getting the law courts in Manhattan to rule in favor of forcing Argentina's hand to pay full repayment. The court's position was that if the hedge funds that owned 7% of the debt didn't get their full money back, then no one else would get their money either. The payment was frozen and Argentina was pushed into another default. This created a lose-lose situation for all parties involved, since no one ended up getting their money back. However, what is even worse is the implications of this situation on a global stage and the future of debt renegotiations. In the past creditors practiced lending money in good faith. These creditors understood that their investment was a gamble. If the country in question defaulted, then they would take the responsibility for the risk. These lender countries would take whatever the indebted country was capable of paying out and take things from there. Yet now with the new precedent set by U.S. courts, the very structure of debt restructuring is thrown into question.

Creditors may be less generous in the future with the knowledge that the repayment of their loans could be denied in lieu of the impossible demands of a select few. This ruling may also make many countries around the world less willing to deal with U.S. creditors or U.S. courts at all. Should a select few be legally allowed to drive a country into financial default? We think not.

So with the escalating growth of world debt and a lack of mechanisms to realistically deal with this growing debt, the possibility of a new financial crisis looms ever closer on the horizon. It is time to put in place a realistic plan for renegotiating public debt before it is too late.

TOP REPORTS AND CHARTS

Deleveraging? What Deleveraging? PDF (Geneva Reports on the World Economy)

Debt and (Not Much) Deleveraging (McKinsey, February 2015)

Chart of Global Domestic Product for Each Country Around the World (World Bank 2013)

The $12 Trillion Bailout (World Future Fund)

Has Too Big To Fail Become Too Big to Jail? (World Future Fund)

RELATED ARTICLES

GLOBAL DEBT

Record Global Debt (RT, 9-30-14)

Interactive: Climbing the global debt mountain (Financial Times, 2-5-15)

Public Debt as a Percentage of GDP in Countries Around the World (Global Finance, 3-7-13)

Global Deficits Will Create $4.5 Trillion in New Debt: Hedge Fund Manager (CNBC, 8-17-10)

Record Global Debt Risks New Crisis - Geneva Report (RT, 9-30-14)

ARGENTINA DEBT CRISIS

What Argentina’s Sovereign Debt Dispute Means for Global Finance (NACLA, 11-18-14)

Argentina right to seek global debt restructuring: Stiglitz (Reuters, 9-9-14)

Obama Can End Argentina’s Debt Crisis with a Pen (Nation of Change, 8-9-14)